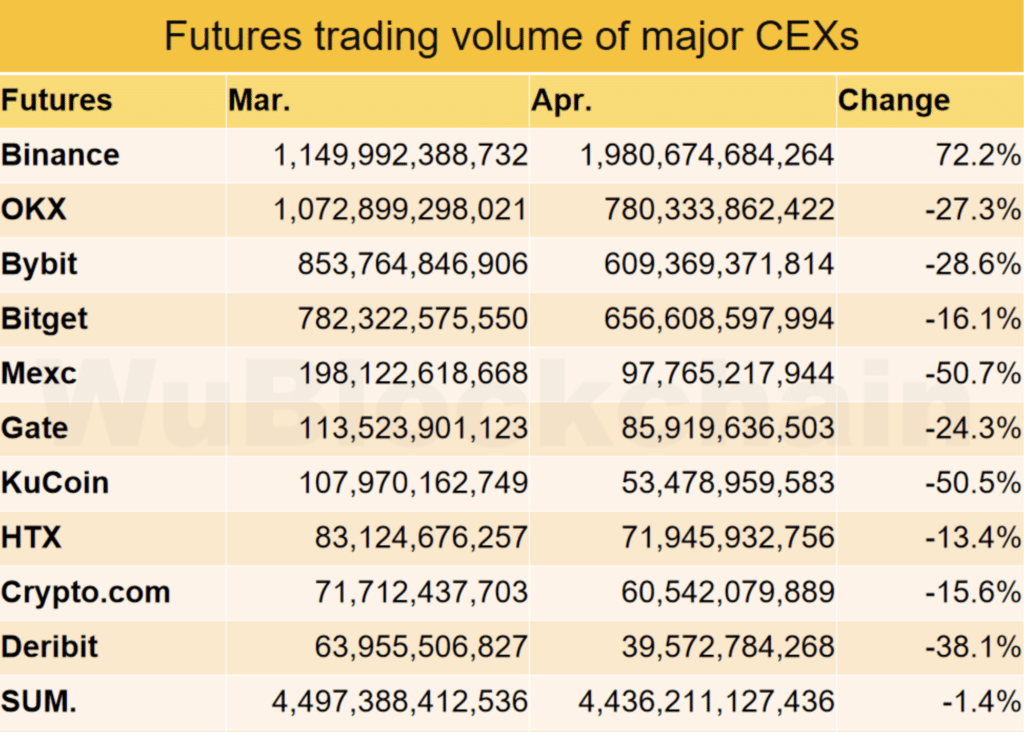

Derivatives trading volume on the largest exchanges experienced a 1.4% decline month-on-month in April. Conversely, futures trading volumes on Binance, the leading centralized exchange (CEX), surged by over 72% from March to April.

The Wu Blockchain team attributes the significant surge in trading volume to Binance’s introduction of a temporary fee discount for USDC perpetual contracts, resulting in an uptick in trading activity for such contracts.

However, when excluding this factor, the overall trading volume in April experienced a notable decline of 26.6% compared to the previous month. Among the exchanges, Bitget saw a 16.1% decrease, Crypto.com experienced a 15.6% drop, and HTX recorded a decline of 13.4% in futures trading volumes, marking the three largest decreases.

Spot trading volume experienced a significant drop of nearly 38% compared to the previous month. Among exchanges, Gate was the sole platform to witness an increase in activity, rising by 13.7%. Conversely, Kucoin suffered the most, with a staggering 70.8% decline, followed by Upbit with a 57.5% decrease, and Bitfinex with a 47.7% reduction.

In early April, Binance Futures initiated a promotional campaign offering trading fee discounts on all USDC-margined perpetual contracts. Throughout the promotion, Binance users enjoyed reduced fees when trading such contracts.

This promotion coincided with Binance founder Changpeng Zhao’s sentencing to four months in prison for violating the Bank Secrecy Act. Additionally, Binance was fined $4.4 billion as a consequence. Zhao, after pleading guilty, reached an agreement with the authorities, resigning as Binance’s CEO and agreeing to pay a $50 million fine.

Read More: Turbo memecoin surges 40% amidst rising U.S. trend

Disclaimer:

This content is AI-generated using IFTTT AI Content Creator. While we strive for accuracy, it’s a tool for rapid updates. We’re committed to filtering information, not reproducing or endorsing misinformation. – Jomotoday for more information visit privacy policy

Leave a Comment